“When we started in 2016 and 2017, most of FinTech was actually in payments.”

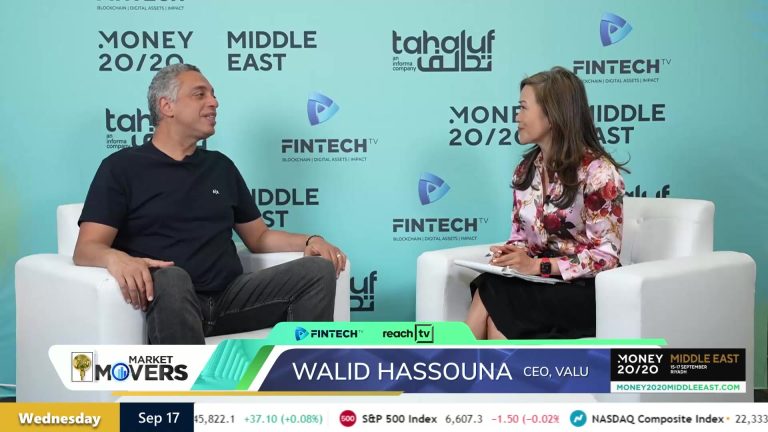

Walid Hassouna, CEO of Valu, joins Patricia Wu from Money20/20 Middle East, held in Riyadh, to discuss the buy now, pay later (BNPL) services sector in the region.

Patricia opens the discussion by highlighting the vibrant atmosphere of the fintech landscape at the conference. Walid shares his insights on the rapid growth of fintech in the Middle East, noting that the sector has evolved significantly since Valu’s inception in 2016. Initially focused on payments, the fintech industry has expanded to include various verticals such as lending, regulatory technology (RegTech), insurance technology (InsureTech), and cybersecurity. Walid emphasizes that the introduction of consumer lending in Egypt marked a pivotal shift, sparking interest and innovation across the region.

As the conversation progresses, Walid discusses the fierce competition in the fintech space and how Valu has managed to maintain its position as a market leader despite facing 49 competitors. He attributes this success to a strong focus on innovation and the development of products that resonate with customers. Walid explains that Valu prioritizes speed over accuracy in product development, allowing the company to quickly adapt to market demands and customer feedback.

Walid also highlights the youthful demographic of his leadership team, which he believes enables them to connect effectively with their target audience. He points out that the team’s background in both banking and technology provides a balanced approach to fintech, setting Valu apart from other companies that may lean too heavily in one direction.