This holiday season, brand campaigns are evolving to reflect a more authentic portrayal of festive moments, steering away from the overly polished scenes we’re accustomed to. As nostalgia continues to reign supreme, brands are increasingly embracing chaos, messiness, and genuine human experiences that resonate more deeply with consumers. In an insightful discussion at the New York Stock Exchange, Crystal Foote, the founder and head of partnerships at Digital Culture Group, shared her perspective on how businesses can connect with their audiences during this pivotal shopping period.

With record-breaking sales numbers during the holiday weekend, Crystal emphasized the importance of authenticity in brand messaging. According to her, brands must take the time to understand their core consumers and speak to them in a way that resonates personally. She noted that in a world where every dollar counts, consumers are looking for brands that can enhance their lives and offer convenience, especially at this time of year.

The data reflects a shift in consumer behavior, with a reported need for brands to align more closely with the needs and realities of their customers. For Crystal, this means understanding what small actions or offerings can help consumers feel supported amidst their holiday shopping chaos. She pointed out that Thanksgiving, Black Friday, Small Business Saturday, and Cyber Monday open a plethora of opportunities for brands to make meaningful connections.

One of the key insights Crystal shared was the vital role small, community-rooted businesses play in this cultural landscape. Citing that these establishments are responsible for over 50% of employment in the country, she stressed the importance of supporting local businesses alongside larger retailers. Crystal’s argument is that small businesses are often the innovators within their communities, engaged in crafting products and services that reflect local values and needs.

As the conversation turned to cultural intelligence, Crystal highlighted the differences in sales and engagement strategies between small businesses and large retailers. She explained that small businesses focus on creating handcrafted, locally sourced items, which avoids many issues that arise from overseas production and tariffs. Crystal argued that shopping locally not only benefits the community but also supports entrepreneurs striving to provide for their families.

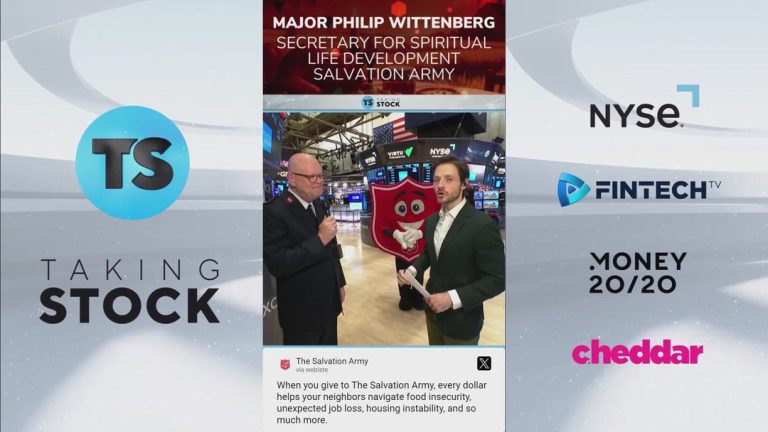

With the hosting backdrop of the New York Stock Exchange, Crystal underscored that all businesses—irrespective of size—are navigated by various external forces that affect their profitability. Tariffs and economic downturns certainly play a role, but there is also immense potential for growth and community support. For viewers looking to support local brands during this holiday season, Crystal’s advice extends to looking at nonprofit organizations that also require support. She shared a powerful example of a campaign run for Toys for Tots, which resulted in providing gifts for 12 million children across the country due to effective marketing efforts.

Crystal concluded with a call to action for shoppers this holiday season. She believes consumers must explore options beyond just larger retail giants, but also embrace the spirit of giving by supporting nonprofits and small businesses alike. The landscape of holiday shopping is shifting, and now more than ever, there are ample opportunities to make a positive impact.